MK3|Oct. 10,2025

Imagine a tool so powerful it manages over $21 trillion in assets—more money than the economies of the UK, Japan, and Germany combined. That’s BlackRock Aladdin, a software platform that’s quietly revolutionizing how the world handles investments. Built by BlackRock, the largest asset management company on the planet, Aladdin isn’t just a program—it’s a financial juggernaut. It helps banks, governments, and even the Federal Reserve keep tabs on investments, dodge risks, and plan for the future. So, what makes this tech marvel tick? Let’s explore its story, how it works, and why it matters to everyone—not just Wall Street insiders.

What Is BlackRock Aladdin?

BlackRock Aladdin, short for Asset, Liability, Debt, and Derivative Investment Network, started as a simple idea in the late 1980s. Back then, founders Charles Hallac and Benett Golub wanted a way to analyze tricky mortgage portfolios. Fast forward to today, and Aladdin has grown into a beast of a platform. It tracks investments across stocks, bonds, real estate, and more, serving over 200 clients worldwide. For example, big names like CalPERS and Deutsche Bank rely on it to manage billions.

Above all, Aladdin shines at risk management. It doesn’t make trades itself—humans still call those shots—but it crunches data to spot dangers before they hit. Think of it as a super-smart financial advisor, always watching the markets. By 2020, it handled $21.6 trillion in assets, a number that keeps climbing as BlackRock expands its reach.

How Did Aladdin Come to Life?

The story begins in 1988 when BlackRock was just a small outfit. Hallac, often called Aladdin’s first architect, teamed up with Golub to tackle a problem for General Electric. GE owned Kidder, Peabody & Co., a firm drowning in a messy mortgage portfolio. BlackRock built Aladdin to untangle it, and they nailed it. Soon after, Kidder was sold off, and Aladdin proved its worth.

However, the real turning point came in 1999. BlackRock realized other companies could use this tool too. They started selling it, and demand exploded after the 2008 financial crisis. Why? Risk management became a hot topic, and few firms had the skills to handle it alone. Aladdin stepped in, offering a lifeline. For instance, the U.S. government trusted it to manage $130 billion in toxic assets during the crisis. From there, Aladdin’s growth took off like a rocket.

How Does BlackRock Aladdin Work?

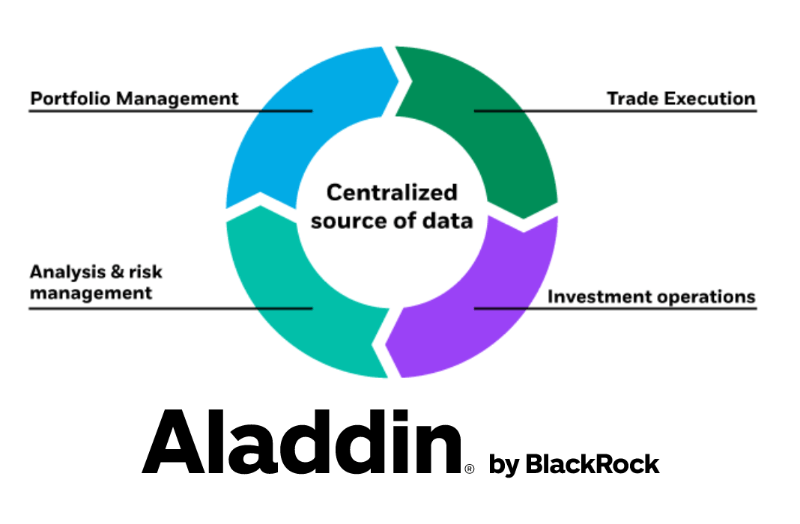

So, how does this thing actually function? At its core, Aladdin uses artificial intelligence and mountains of data to analyze investments. It pulls info from global markets—stock prices, weather changes, even political shifts—and runs simulations. These Monte Carlo simulations, as experts call them, test thousands of “what if” scenarios. What if a pandemic strikes? What if a bank collapses? Aladdin shows the fallout.

Moreover, it’s not just about numbers. The platform connects traders, compliance teams, and accountants on one system. Before Aladdin, these groups often worked in silos, juggling different tools. Now, they share a common language. Take a pension fund manager worried about travel stocks during COVID-19. Aladdin lets them zoom in on that sector, stress-test it, and adjust fast.

The tech behind it is cutting-edge too. Aladdin runs on Linux, Java, and tools like Hadoop and Kubernetes. It humps along on 6,000 computers in places like Wenatchee, Washington. Together, they process real-time data, making sure clients stay ahead of the curve.

Why Aladdin Matters to Big Players

Big institutions love Aladdin for a reason—it’s a game-changer. Banks like Credit Suisse and insurers like Prudential use it to oversee massive portfolios. Even the Federal Reserve taps it to keep the economy steady. Why? Because Aladdin offers a clear, real-time view of risks across public and private markets.

For example, after BlackRock bought eFront in 2019, Aladdin added private assets like real estate and private equity to its toolkit. This matters as more investors shift to these areas. Previously, tracking those investments was a mess—think spreadsheets and guesswork. Now, Aladdin ties it all together. A pension fund can see how a skyscraper investment stacks up against its stocks, all in one place.

Additionally, it’s flexible. Clients can tweak it to fit their needs, whether they’re dodging climate risks or meeting new rules like Dodd-Frank. No wonder it’s become the go-to for over 30,000 portfolios worldwide.

The Power—and the Controversy

With great power comes great scrutiny, and Aladdin has plenty of both. Some call it “the Fed’s brain” because of its role in government decisions. During the 2008 crisis, BlackRock used Aladdin to value Fannie Mae and Freddie Mac’s assets, steering the U.S. through chaos. Later, it managed $1.25 trillion in mortgage-backed securities for the Fed. That’s a lot of sway for one tool.

However, not everyone’s a fan. Critics worry it’s too powerful. Posts on X have dubbed it a “global market trap,” hinting at fears it could control finance behind the scenes. Others point to BlackRock’s insider edge—Aladdin sees data from competitors, giving the firm a peek at the whole gameboard. BlackRock insists it keeps client info locked tight with audits and strict rules, but the debate rages on.

For instance, if Aladdin spots a market dip coming, does BlackRock benefit first? No hard proof exists, but the question lingers. Still, clients keep signing up—HSBC recently joined the list—suggesting the benefits outweigh the doubts for now.

Aladdin’s Role in Sustainability

Another key point: Aladdin isn’t just about profits—it’s tackling big issues like climate change. In 2021, BlackRock teamed up with Clarity AI to weave environmental and social risks into Aladdin. The result? Aladdin Climate, a feature that tracks a portfolio’s path to net zero and flags green opportunities.

Take a company like Glencore, a coal giant where BlackRock holds a 9.2% stake. Aladdin can test how climate policies might hit that investment. Critics ask if it’s enough—BlackRock still owns chunks of fossil fuel firms like Holcim. Yet, the tool gives clients data to decide for themselves. Whether that saves the planet or just their wallets is up for grabs.

What’s Next for BlackRock Aladdin?

Looking ahead, Aladdin’s ambitions are sky-high. BlackRock’s “Tech 2025” plan aims to make it the “language of portfolios” for all asset managers. With the 2024 Preqin buy, it’s diving deeper into private markets. Meanwhile, partnerships with Microsoft Azure are pushing it into the cloud, boosting speed and scale.

Furthermore, AI is getting smarter. Aladdin’s already testing portfolios against wildcards like geopolitics and natural disasters. Soon, it might predict trends no human could spot. For example, COO Rob Goldstein sees it uniting public and private investments seamlessly—a holy grail for the industry.

But challenges loom. Rivals like SimCorp and Two Sigma are nipping at its heels with their own platforms. Plus, as markets get choppier, Aladdin’s clients demand more. Can it keep up? So far, its track record says yes—revenue from tech services hit $274 million in a single quarter last year.

The Human Side of Aladdin

Despite its tech wizardry, Aladdin doesn’t run on autopilot. People—thousands of them—keep it humming. From coders in Wenatchee to risk experts in New York, they feed it data, tweak its models, and interpret its insights. It’s a reminder that even the slickest AI needs human hands.

Clients feel this too. A manager at Columbia Threadneedle once said Aladdin’s real magic is how it frees them to focus on strategy, not grunt work. It’s less about replacing humans and more about supercharging them. That balance might be why it’s stuck around for over 30 years.

To Wrap Up

In closing, BlackRock Aladdin isn’t just a tool—it’s a force reshaping finance. It started as a mortgage fixer and grew into a $21 trillion titan, guiding banks, governments, and investors through a wild world. Its AI smarts, vast reach, and adaptability make it unmatched, though not without controversy. As we move forward, its role in sustainability and market stability will only grow. The real question is: what will we do next with this power? Only time will tell if it’s a hero or a hazard, but one thing’s clear—it can’t be ignored any longer.

Source:Making Sense of The Infinite